Like many other financial bloggers, I logged in to the CPF website a week ago. The CPF interest for 2017 were finally credited.

However, unlike other financial bloggers, I have neither done a CPF OA to SA transfer nor performed any Retirement Sum Top-Ups to my CPF accounts so far. And as a self-employed, I have also not made any Voluntary Contributions (VC) to my CPF accounts.

The only contributions I have made in the past two years were the mandatory Medisave Contributions as a self-employed.

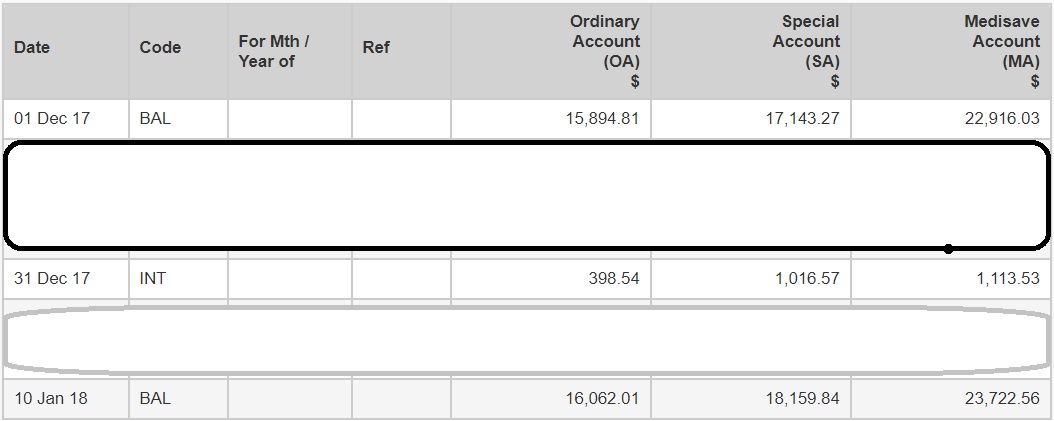

So it’s not surprising that my CPF balances are very modest (even below EI threshold of $60,000), as seen below.

Despite the modest balances, I could still find myself smiling from ear to ear knowing that I had accumulated $2,500 worth of CPF interest for the previous year.

But still, I cannot see myself voluntarily contributing more to my CPF accounts any time soon. Even if the interest is enticing.

Here are the reasons why:

1. Quietly Confident Of Achieving 6% Returns Myself

Let me first clarify that I am not bashing the CPF system. In fact, I actually think that the CPF is a great system. Instead of being a defined benefit pension plan, it’s actually a much more sustainable defined contribution system (go google it if you don’t understand).

And the CPF SA, MA and RA base return of 4% is a really generous risk-free rate, especially considering the strength of the SGD over the past few decades.

However, I am prepared to take some risk and stomach some volatility in search of higher returns. As stated in this post, the aim is to achieve 6% p.a. on average, which I have just about managed to do for the past 7 years.

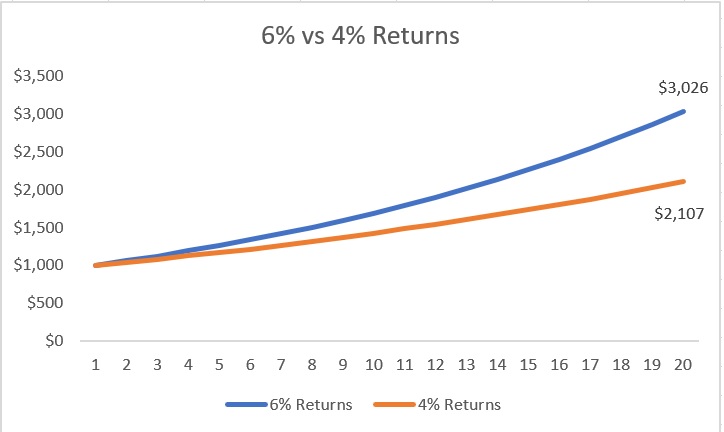

You might think a 2% difference is nothing. But this is how a 6% p.a return vs a 4% p.a return would look like over 20 years.

For a $1,000 investment, it would have grown to $3,026 (6% p.a. returns) vs $2,107 (4% p.a. returns) over a 20 year horizon. That’s close to an extra $1,000, almost the same amount as the principal!

2. CPF Funds Unable To Provide Short-Term Security

That said, I do understand that the higher returns are not guaranteed. And those who scrutinise the portfolio a little closer would also realise I do hold quite a bit of cash and bonds.

So it’s pretty natural to hear this well-intentioned argument:

Dear 15HWW,

Instead of holding so much bonds and cash that provide you with low yields, why not transfer them to your CPF accounts to enjoy HIGHER interest and BOOST your returns?

This reasoning actually holds quite a bit of water.

My UOB One Account only yields about 2.43% p.a., a return lower than the base rate for CPF OA. And the bond with the highest yield for me is the Frasers Centrepoint Limited (3.65% p.a.) Bond. The 3.65% yearly coupon is lower than the 4% p.a. base return of CPF SA and MA.

So rationally, liquidating some of these cash/bonds to top up my CPF accounts would make improve the numbers.

However, in my humble opinion, the biggest perk of money is being able to provide SECURITY. Which my CPF funds cannot provide, at least in the short-term.

I am a self-employed. My income is definitely not as secure or certain as compared to a public servant. The threat of lower income or even no income looms on the horizon, especially if I am suddenly made obsolete by my industry.

Even if I were a CPF millionaire, it would not help with the above. In the hypothetical scenario where my circumstances turn quite dire, there is no way I could access these CPF money (besides medical reasons) if I am below the age of 55.

And yes, I still have more than 20 years to go before turning 55.

So having a 6-digit amount in cash and bonds provides peace of mind and allows me to sleep better. My expenses for the next 4-5 years can potentially be covered by these savings.

Unfortunately, this short-term security is something CPF funds are unable to provide.

3. CPF Funds Unable To Offer More Options In Life

I believe the second biggest perk of money is being able to offer more OPTIONS in my life.

The Mrs and I have about $200,000 of cash, bonds and commodities at this point in time. These are some of the things we could do tomorrow if we liquidated these assets:

a) Spend it on a dinner or

b) Buy a BMW 320i Shadow Edition Series or

c) Move to Chiang Mai and stay there for 10 years or

d) Slow travel in North America for 3 years or

e) Help my siblings to purchase a house or

f) “Invest” it in cryptocurrencies, hope the money grows to $1,000,000 in half a year’s time, then we can do all of a), b), c), d) and e)

Whether any of the above makes sense or not is besides the point. The fact is that I am below 55 and I cannot use my CPF money to pursue any of these options.

Honestly, for some people or even most people, that can be a good thing. But knowing myself, I really prefer to keep my options open for now.

Thanks for reading till this far.

I am not sure if you will be surprised to hear this. But if I were a betting man, my wager will be on the both of us wanting and being able to fulfil the Full Retirement Sum when we turn 55.

And surprise, that will likely require some active and voluntary top-ups eventually.

The time to contribute more to our CPF balances will come when we become older, have higher income and also, more assets to our name.

So, The (Yet) is in the title for a very good reason.

Nice view 🙂 But i guess you don’t have children as yet. View might change when you do. 🙂

Hi Newbie,

Thanks for the comment.

Actually, I am thinking with children, the demand on cash flow would be greater and there should be even less inclination to top up money into CPF?

15HWW,

Your “yet” is most telling 😉

One simple word – but it shows you have thought it through for yourself, and have come to a decision based on your current situation 😉

😉

Hi Jared,

Ownself must think for ownself! Cannot outsource!

Hi 15HWW,

Thanks for sharing. My reasons for not “optimising” CPF (yet) are the same as yours.

I often feel that I’m quite silly not to do CPF top-ups/VC to benefit from tax reliefs and also the not-insignificant risk-free interest rates (particularly, VC to CPF-MA), but I can never bring myself to for the reasons mentioned above.

Further, for super early retirees/semi-retirees, the accessibility of assets is of foremost importance.

Hi sb,

I see you have reflected deeply too.

If I were to top up my CPF, it’s likely the first thing I would do is to VC to CPF-MA too! Healthcare insurance is increasing year by year.

I keep hearing CPF Top up, top up and top up until sianz!

This is refreshing!

How many people including investment bloggers know the huge difference between rich assets and good assets?

CPF OA and SA are rich assets until when one achieves FRS at 55.

Hi CW8888,

Yes, I am also tired like you. So thought that it’s time to provide a different perspective.

I guess your CPF OA and SA are both good and rich assets now for you!

Enjoy your trip and catch up again soon!

^5

As a salaried employee, I have different circumstances from you. A large enough proportion of my income is already been funneled into the CPF system. I don’t see a need to add on to it.

The most important factor for me is flexibility – which CPF sorely lacks. This is why I’m in the same camp as you – I have never topped up my CPF too! Looks like there is quite a few of us.

Hi Kevin,

If I were an employee like you, I think I probably won’t ever need to top up my CPF!

Not to mention that you can already pay off your house. 36% of your salary goes straight to your retirement!

Hi 15HWW,

Great post and balance view on CPF top up ,,, yah !! “different strokes for different folks” ,, one should view and do the transfer base on each own financial situation and objectives …and also at what stage of their financial life cycle …

Cheers !! 🙂

Hi STE,

I have a feeling you barely made any top-ups to your CPF accounts before this decade too!

But glad that you are already enjoying “substantial fruits” from your CPF accounts.

What about tax benefits? If you put cash into CPF SA, you get tax savings of whatever your income tax bracket is. I calculated that between putting cash into CPF SA and taking that cash to invest, it’s more attractive to put into SA by far. Even at a 2% income tax bracket, you’ll need 7.14% returns in investments to outperform the CPF SA returns + tax savings. At the 7% bracket, it’s 12.9%.

Hi Weihan,

Curious as to how you got your numbers.

Anyway, the tax savings are only for a year. So I am pretty sure if investment return is 5% p.a. for 10 years, it will surely beat the SA returns and tax savings.

I feel the biggest consideration is having the “assurance” that you won’t need the money for the next 20 or so years. A pity I don’t have this confidence, otherwise I will top up my CPF and enjoy more 4% risk-free returns too.

I’m a self-employed like you. However I have voluntarily top up CPF to the max of $37740. This sum will include whatever you need to contribute to CPF-MA as a self-employed. Main bulk will go to CPF-OA which I can utilise for my monthly housing loan. The rest will go to CPF-SA which earns a 4% risk free interest rate. So out of $37740, I am really only “voluntarily” topping up my CPF-SA as contribution to CPF-MA is mandatory for self-employed and I am paying my housing loan using CPF-OA.

Of cos, the main draw of all these is the income tax savings which can be quite substantial as the full sum of $37740 is offset against your chargeable income. It can easily lowered your tax bracket by one rung. It makes total sense for middle to high income earners to top up CPF.

The immediate investment return of doing a voluntary CPF top up is actually (overall tax savings / money which goes to CPF-SA), since you can’t avoid CPF-MA contribution and housing loan. The return is in high double digits. Subsequently, you get 4% risk free interest rate every year.

Hi James,

Thanks for sharing your perspective.

I fully agree with your rationale and reasonings and I would also likely VC to the max $37,740 if I were earning >$100,000 a year. =p

Putting 7k VC per year doesn’t take away any of those options so I’m not sure why you say it as a put or don’t put scenario.

I wouldn’t do VC either if my cashflow will be negative due to it. I’m self employed too 🙂

Hi Eric,

Thanks for dropping by and sharing your view.

Well, putting $7k into your CPF SA would likely mean losing accessibility to this $7k for the next two to three decades. So it still boils down to a put/don’t put scenario.

I guess the main thing is I don’t get much tax savings out of it, so there’s really very little incentive to top up at this point in time.

Understand what you mean, true that we will not be able to access that 7k until 55.

For me i have allocated different percentage to different needs, e.g. pay bills, savings, investing, insurance, business, travel etc.

And once i have at least 2 years of cash saved up for emergency needs, i channeled the rest to work for me. Letting it sit in the bank is not very profitable for me.

Yes, the tax savings is a big reason why i chose to top up my SA 🙂

Hi Mr.15HWW

Good point about having access to fund when you need it. Hence why SippingCoconuts consider CPF funds our chef’s surprise part of our FIRE portfolio. (https://www.sippingcoconuts.com/what-will-our-fire-portfolio-be/)

Having said that, I did top up in 2017 because our situation is slightly different. When we bought our current place, I cleared out my CPF because it was not long after moving to SG so my CPF didn’t have much funds anyway. Then I transferred balances from OA to SA for the higher interest and kept minimal balance in OA for servicing the home loan. Because the loan installment is higher than the usual monthly CPF contributions (huge loan…sigh) I would need to eventually settle any difference with free cash. So I thought I might as well top up my CPF OA for the tax benefit since I’d need to eventually pay out of pocket anyway. I only did a quick mental analysis and made the transfer straight away since it was only $7k so not sure if my decision was right. Haha 🙂 Would like to hear your thoughts.

Hi Mr C,

^5 with regards to how we view our CPF funds.

From my understanding, it is not possible to do a top up just to CPF OA account. You meant a Voluntary Contribution to all 3 CPF accounts right?

In that case, some of the money would go to MA or SA then (maybe about 30-40%?).

But if the tax savings is substantial, it could still be a good move since the bulk goes to OA and OA funds can be considered liquid in your case.

Hope the above helps.

Hi M15HWW

Took me some time to figure out what ^5 meant. Haha.

Anyway, I just revisited my top up decision last year. The S$7k would be topped up to the SA only, not the OA. So it’s mainly for the tax benefit, but no double benefit as I can’t use it for the home loan installments.

Hello 15HWW!

I also do not advocate in topping up our CPFs and believe that liquidity is very important. Liquidity in its nature would supercede most of the benefits of doing so.

I resonate very much with all the points you have blogged about, especially if we are nowhere close to the retirement age (who knows what might happen to SG >_<)

Thanks for sharing!

Hi Miss Niao,

Yes, you are right that flexibility and liquidity should be the most important factors. Being able to get slightly higher returns is secondary.

I haven’t even talked about the possibility of rule changes, especially a delay in withdrawal age. >_<

I have just cleared my housing loan in Dec 17 (from 30 years period down to 10 years)…thus now don’t know if I should leave the money in OA for future property investment or do a transfer from OA to SA to reap the higher interest rate (after considering the $60k cap on extra 1% interest)…