Genesis

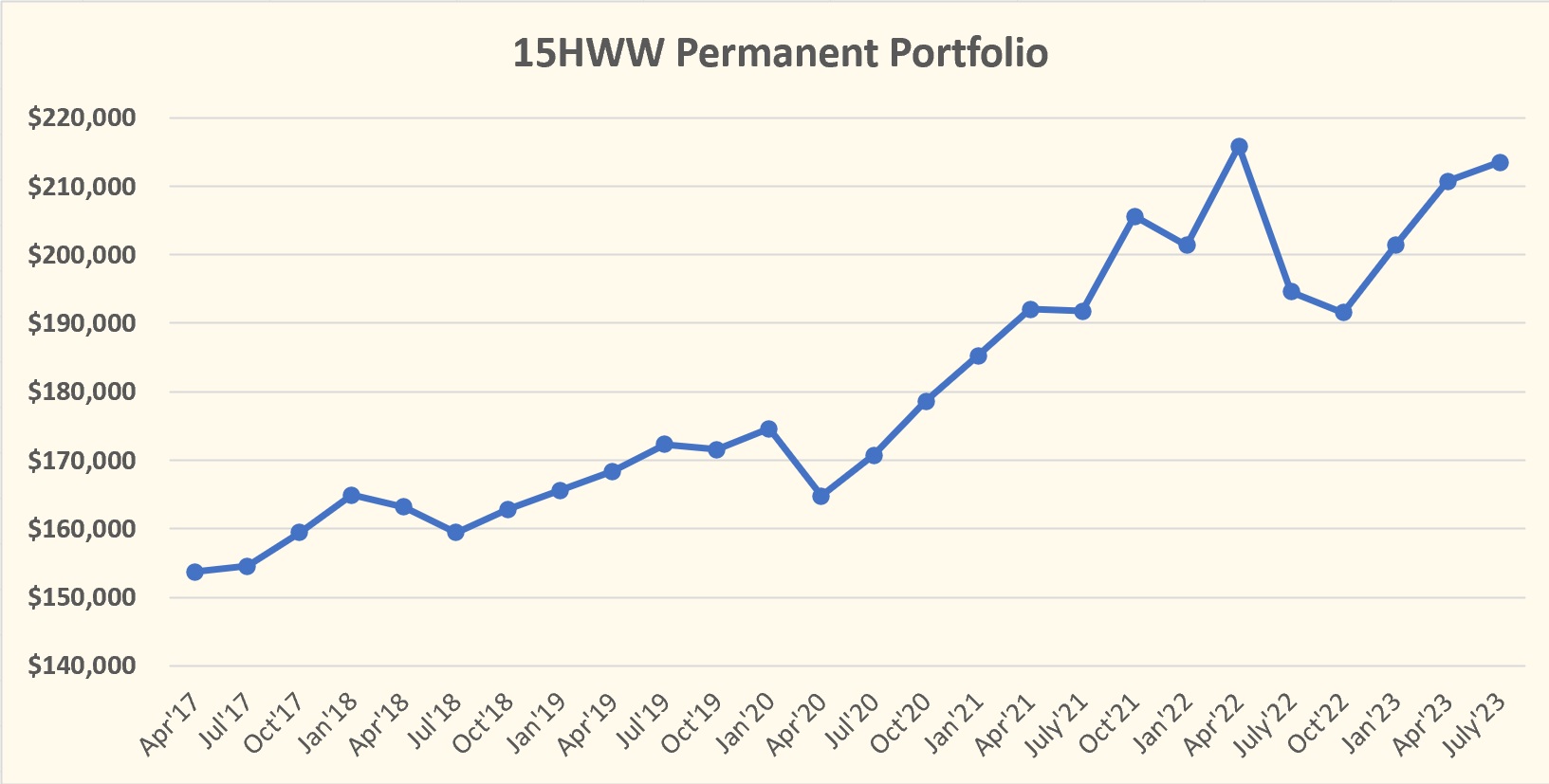

The 15HWW Permanent Portfolio was built during late 2016 with a capital of around $140,000 and I started tracking it from Jan 2017.

The aim of a permanent portfolio is to create a liquid portfolio with low volatility and a respectable return. A comparative benchmark is the CPF SA return of 4%.

To keep the portfolio as simple as possible, there is neither rebalancing nor injection of funds.

Purpose

Personally, I view many components of this portfolio as a form of emergency fund. For example, the cash and bonds are invested in very liquid and safe instruments and can be sold and cashed out within a matter of days.

Another reason is that by showcasing and regularly updating this humble portfolio, I hope it will inspire confidence in some readers to take some risk, invest and build wealth steadily with a low-effort portfolio.

Portfolio Value From Jan 2017 To Jul 2023

July 2023 Update

Annualised Return: 5.5% p.a. (Jan 2017 to Jul 2023)

An ok quarter for the 15HWW Permanent Portfolio and we are slowly approaching April 2022’s ATH update of 215k.

Recession? What recession?

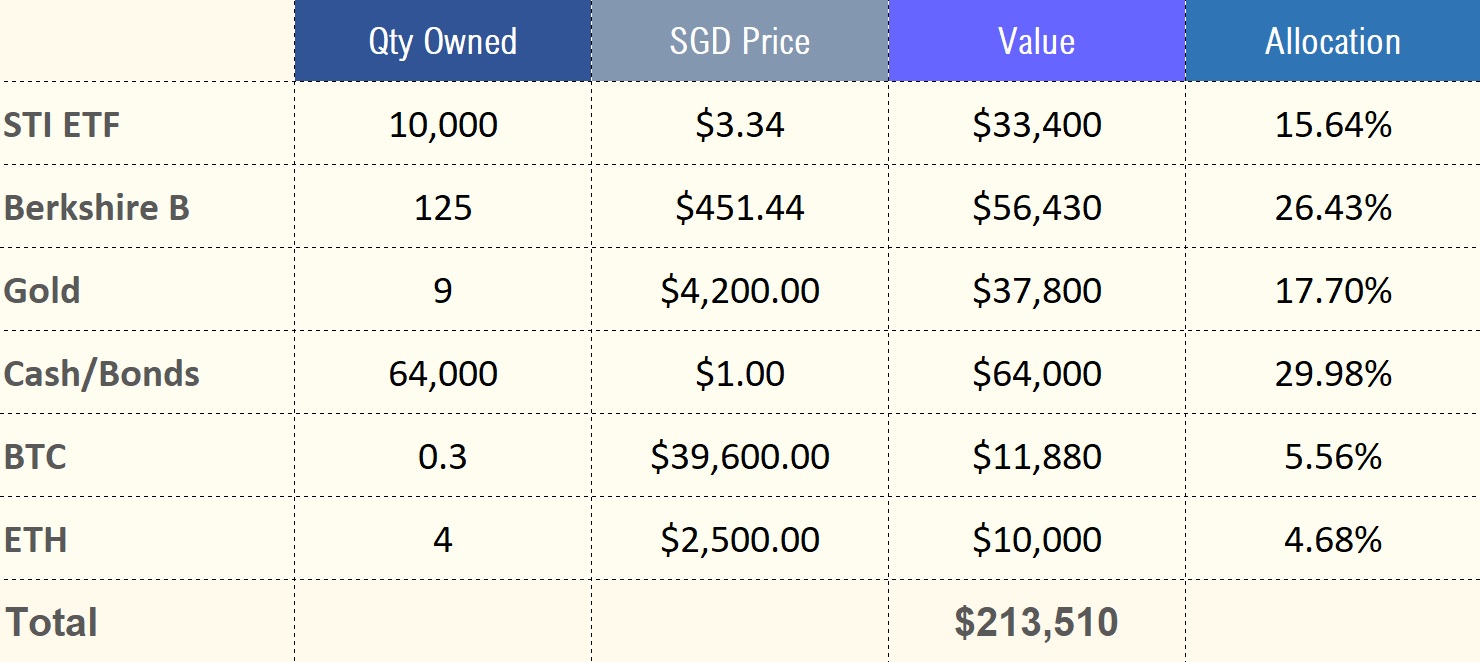

The portfolio is up by a small amount of SGD3k compared to a quarter ago and interestingly, I would say almost all assets are up, albeit just very slightly.

Somehow the vibe I am feeling is that the coast is not really clear. US Big Tech has led most of the gains. I sold most of my big tech stocks (Microsoft, Amazon and Meta etc) during the run-up in June and probably missed out on potentially 20% of gains. The plan was to add back slowly using QQQ if there was a dip, but oh well.

The vibes will truly turn positive if we get a good run-up for the Chinese market. I know quite a few people who are so underwater for so long that I have labelled them “submarine” investors.

Although the 15HWW Permanent Portfolio has no exposure to Chinese equities, I reckon good vibes should have some spillover effect to the STI ETF? This index has behaved like T-bills in the past decade, with its price remaining stagnant and just providing 3-4% of dividends annually.

The annualised return for this portfolio remains at 5.5% p.a., the same as the previous quarter. Definitely not complaining.

Till the next update in three months’ time!

Thank you for reading.

Related Articles:

The 15HWW Permanent Portfolio Update: April 2023

The 15HWW Permanent Portfolio Update: January 2023

The 15HWW Permanent Portfolio Update: October 2022

Annex: A Brief On The Various Components Of The 15HWW Permanent Portfolio

1. STI ETF (Initial Allocation: 20%)

It comprises the 30 biggest listed companies in Singapore and many of them are dividend-paying. The ETF distributes the dividends semi-annually, in February and August every year.

2. Berkshire B (Initial Allocation: 20%)

The idea is to use Warren Buffett’s holding company to loosely replicate the S&P 500 for US equities exposure. Since foreigners investing in US stocks are taxed on dividends, it is an advantage that Berkshire B does not pay any dividends.

3. Gold (Initial Allocation: 20%)

I used to hold some paper gold but have since converted them to physical gold. The portfolio consists of 9 pieces of 50g PAMP Gold Bar bought from UOB Bank. They are fairly liquid since they can be sold back to UOB Bank at a small spread. You can also check the prices here.

4. Cash/Bonds (Initial Allocation: 30%)

The majority is invested in Astrea Bonds and Singapore Saving Bonds (SSBs) which are very liquid in nature. Astrea Bonds are traded on the market while SSBs can be redeemed at par value, usually in a week or two’s time.

5. Bitcoin (Initial Allocation: 5%)

Added in 2021 to diversify away from cash and gold as a store of value. As many centralised crypto exchanges have abused users’ trust in them, my bitcoin is now stored in a cold wallet.

6.. Ether (Initial Allocation: 5%)

Added in 2022 since I am not a Bitcoin Maxi. As many centralised crypto exchanges have abused users’ trust in them, all my ether is staked on-chain.